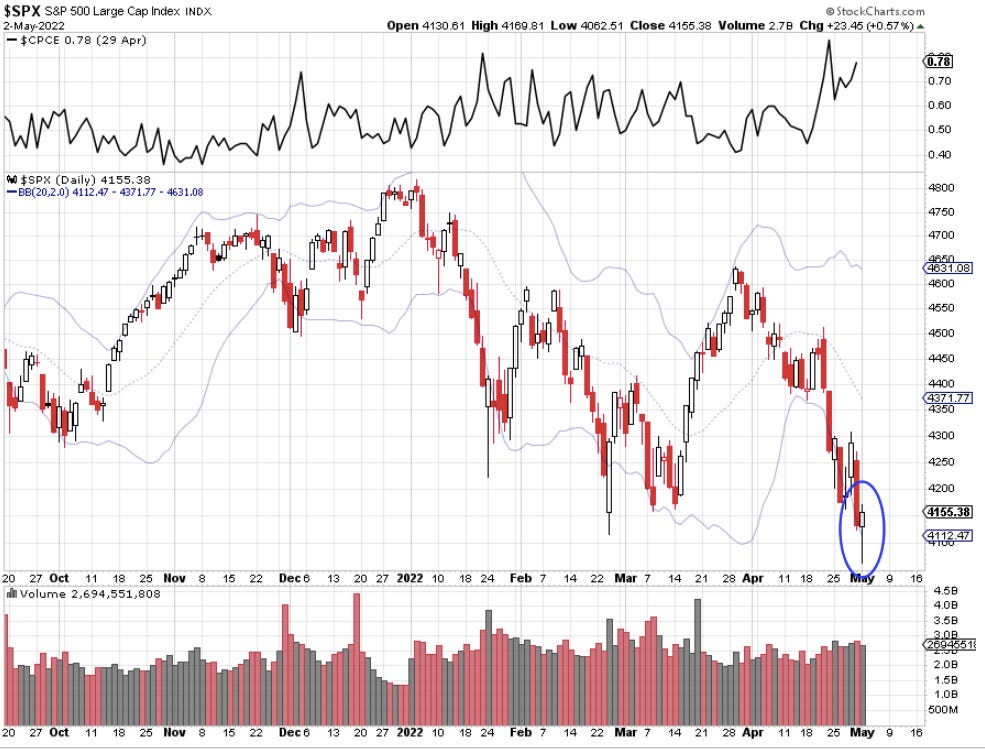

Market Hammers Out Bottom as Fear Peaks

Today the market rallied off the lows, and fear seems to have peaked.

If you’ve noticed, I end all my weekend posts with “what to look for” this week.

As always, I say we need to look for a candlestick reversal. In Sunday’s post, I stressed the importance of a candlestick reversal on ALL three indices. Today we got that, with the VIX confirming.

The Volatility Index (VIX) signaled a bottom is in, because “fear has peaked”. This was the confirmation I was waiting for to trade more aggressively.

Here is a quick look at the chart. See how crystal clear each candlestick pattern is?

Dow Jones Hammer (Daily)

S&P 500 Hammer (Daily)

NASDAQ Piercing Pattern (Daily)

VIX Shooting Star (inverse of a Hammer; Daily)

Notice every time the VIX peaks, the market rallies?

Early December peak fear = rally

Late January peak fear = rally

Late February peak fear = rally

Early May peak fear = rally?

To learn more about how reliable the VIX is with spotting reversals, check out this post, Buy the True “Dip” With This Powerful Chart.

Now is a great learning opportunity to see the potential power of candlesticks.

Final Thoughts

Expect a tradable rally into the Fed announcement Wednesday, as all three indices confirmed one another, and those confirmations were further confirmed by the VIX.

Happy Trading 😊