Stocks Reverse Course, Bears in Control

Today's price action indicates lower prices to come. 3,500 on S&P.

Today we saw a nice pop higher at the open, only to sell off into the close. Yikes for bears.

Watch the video to find out what this means, or continue reading.

I refer to price action like today as an intraday reversal.

This means price rockets in one direction only to reverse course entirely. Intraday reversals come in many shapes and sizes, yet they all have powerful effects on trader psychology.

Think about how it feels to immediately be in a profitable trade, only to see it sour into a loser. That’s what intraday reversals feel like when you’re wrong.

Everyone who is still holding the back will get out as soon as they can the next day (usually). That makes for a great trading opportunity.

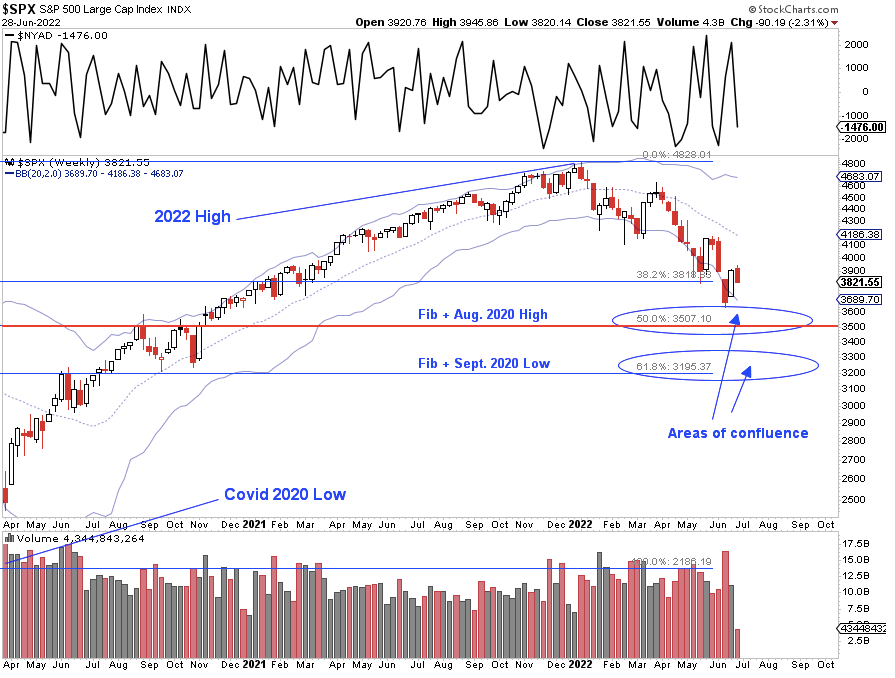

That said, it appears bears will get their shot at 3,500 on the S&P, which is a huge support level:

~3,500 is the August, 2020 highs (prior resistance = future support).

It’s also the 50% Fibonacci retracement from the 2020 lows to 2022 highs, which many traders pay attention to.

For those two reasons, there will be a lot of short sellers who take profits (buy) and buyers who buy at that level. Expect a bounce.

In the meantime, unless we get a bounce carried by good (great news), 3,500 is not out of sight.

Happy Trading 😊