Why the Sell Off in Stocks Will Be Over Soon

The crystal ball is the US bond market, signaling inflation has peaked.

When I first started trading, I was fortunate enough to have met a retired pit trader.

He told me whenever he wanted to figure out “what was next”, he’d look to the bond market. I never forgot that.

It took me years to heed his advice, but now I follow the 10-year bond market religiously. To all you newbie traders, take this post to heart a lot sooner than I did on my trading journey.

What Bonds Are Telling Me About Stocks

The US Treasury market is the market for U.S. debt. If you buy a US Treasury bond, you become the government’s creditor.

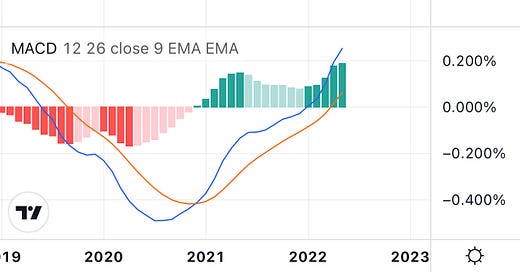

I’m seeing major, major buy signals on U.S. bonds. Which means inflation might slow down.

What’s the buy signal? Well, it’s a dramatic, intra-month reversal at the Upper Bollinger Band of yields. Yields move opposite bonds.

If price holds here until the end of the week, this makes for a high probability trade set-up on bonds.

But what does this mean for stocks, and how can I take advantage of it?

Keep reading or upgrade to find out.