The market is rallying, but will it hold?

Underlying breadth signals strength; feels like good news is coming.

If you have an appetite to learn stock market knowledge, welcome home. To my new subscribers, thank you.

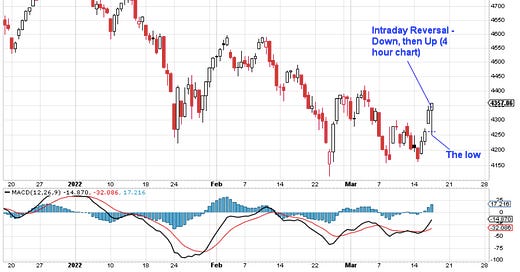

Today the Fed announced they will raise interest rates. Ironically enough it came the day after the Ides of March, a day many Roman debts would come due. Either way the Fed told us nothing new, and the market had a powerful intraday reversal after the news.

Quick Recap on Price Action

A few days ago I noted the market was “technically” set up to bounce hard, but would need good news to sustain it (I suggest you read that post over and over and over again, so you can get familiar with how these tools work).

Today we saw that bounce, and now we need good news. The technicals indicate it’s underway.

Let’s dive in on the price action with what we’ve learned so far at the Academy.

Today we saw an intraday reversal.

I love intraday reversals.

After the Fed announced, the market sold off, and then rallied hard into the close.

This means the bias is to the upside for the next few days.

The line shifted significantly today, too, confirming the reversal.

“The Line” signals the reversal was powerful.

In this post you’ll discover how the A/D line is the equivalent of “the line” Vegas sports books use to “balance” the public’s bet. Seriously. It’s literally called The A/D Line, and it’s a pretty powerful move to filter out fake moves.

A quick rundown of the A/D Line this week so far…

Two days ago, about 1,600 stocks traded down than up (A/D = -1,600)

Yesterday, 1,200 more traded up than down (A/D = 1,200)

Another 900 or so more traded up than down today (A/D = 2,105!)

Out of 3,400 or so stocks, that’s a HUGE swing, easily visible in the charts:

What does The Line generally indicate?

A high A/D line means many stocks are participating in the rally.

A low A/D line means many stocks are participating in the sell off.

High A/D readings usually see higher prices in the following days.

Very low A/D readings see temporary or permanent bottoms, and soon.

The market is set to rally… HARD.

So far, the weekly chart indicates a bullish engulfing, which acted as support for the hammer a few weeks ago.

If this holds into Friday, the market is set to rally hard. It will be a great time to cover the Bullish Engulfing, a topic on my syllabus.

Price MUST hold at this level to be a valid bullish engulfing, and preferably closes at the highs of the week.

Considering we’re coming off the lower Bollinger band….

It feels as though the market is pricing in good news.

Final thoughts. Any rally still needs good news to sustain it.

I said it a few times and I’ll say it again — any rally needs good news to sustain it. The Fed did what they told us they would do, so today’s move happened because there was “no surprise”. BUT, it was a strong move (see the A/D line). That said… the only thing that can sustain this rally is a peace deal.

Happy Trading 😊