The Magnificent 7? More like Horrific 7

There is a MAJOR bubble bursting in the Mag7.

We are seeing sell signals on the Magnificent 7 stocks (Meta, Google, NVDA, TSLA, etc).

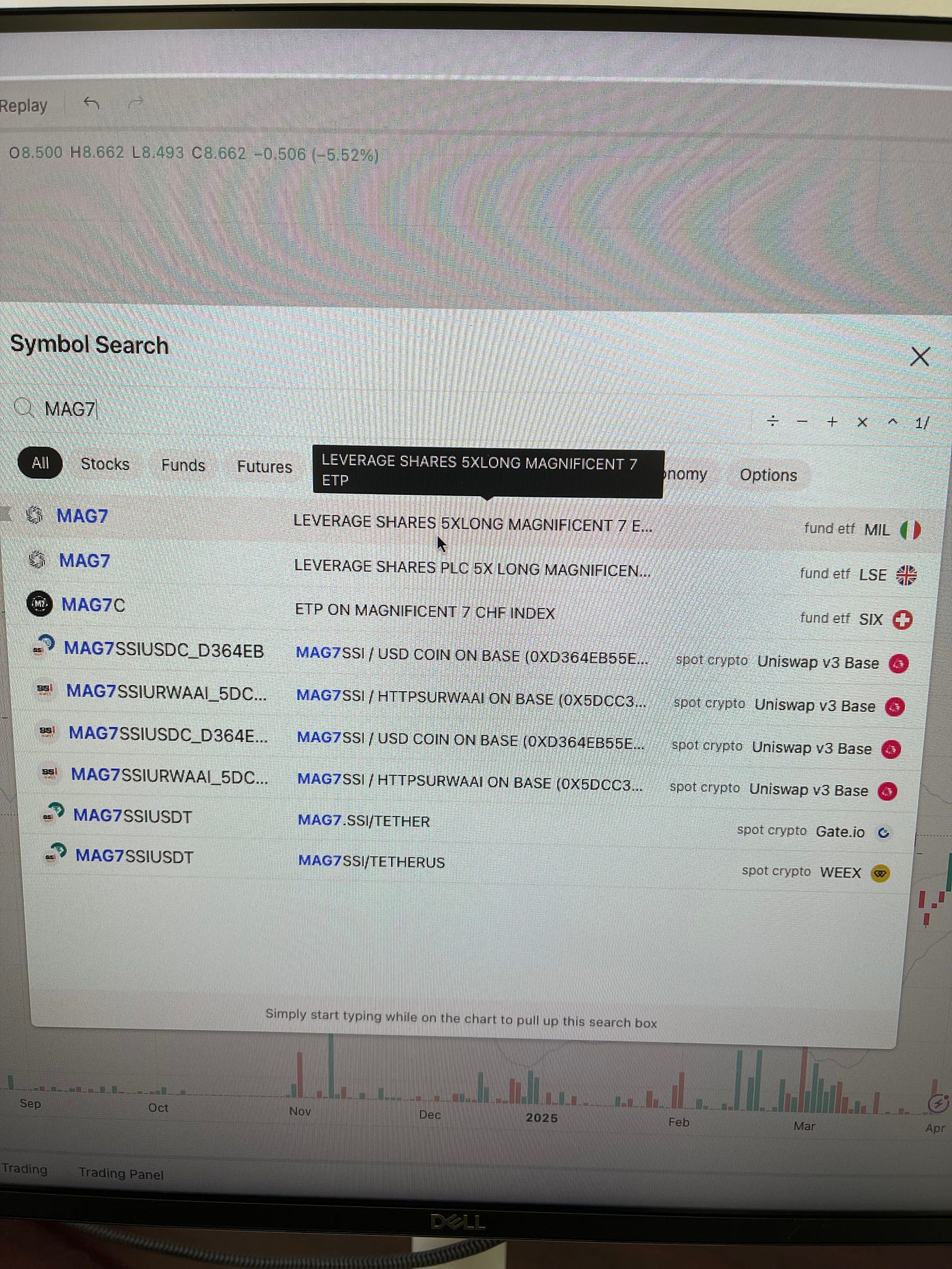

But one thing caught my eye that screams “BUBBLE” — there is a 5X leveraged (!!) ETF for the Mag 7, available in obscure markets like Milan, Italy:

Before I explain what this means….

A quick primer on ETFs…

ETFs are a way to invest in a “basket” of stocks for certain industries. You can buy an Oil ETF or a Mag7 ETF. If those stocks go up 1%, the ETF goes up roughly 1%…

Leveraged ETFs just add fuel to the fire. If the Mag7 stocks go up 1%, the leveraged ETFs go up by 2X, 3X etc. - 2% or 3%.

Same goes for if the stocks go down… which can accelerate a sell off due to panic.

5X Leveraged Mag7 ETF in Foreign Markets

In this case, we have a 5X leveraged ETF tracking the Mag 7 - in Milan, Italy and the London Stock Exchange! An ETF with that kind of leverage isn’t even available in U.S. markets.

Meaning — Retail investors in ITALY and LONDON are propping up the price of the Mag7 stocks. Not institutional investors in America (who are quietly dumping the stock)

And because it’s 5X leverage, if there is a decline, you can bet that everyone will rush to sell their ETFs. Panic will reign. And the Mag7 will collapse….

Why ETFs are a Bubble

The problem with ETFs is that there is no utility to the investment dollars. The money from a retail investor goes straight into the hands of the fund manager, who turns around and buys Mag7 stocks with that money, PLUS borrowed money (that’s where the leverage comes from). All these ETFs do is create leverage in the system and pass the losses onto Retail investors. All while institutions quietly sell their shares to these greedy fund managers.

The Mag7 is a bubble, and it’s about to pop.

Magnificent 7? Will soon be Horrific 7.