Silicon Valley Bank Failed. Is Now The Time To Buy?

I'm a huge fan of buying when fear hits extreme levels.

Since I started this newsletter, I’ve been advocating to buy when “fear peaks”.

I’ll keep it short with an explanation, and instead refer back to two articles that will help bring you up to speed:

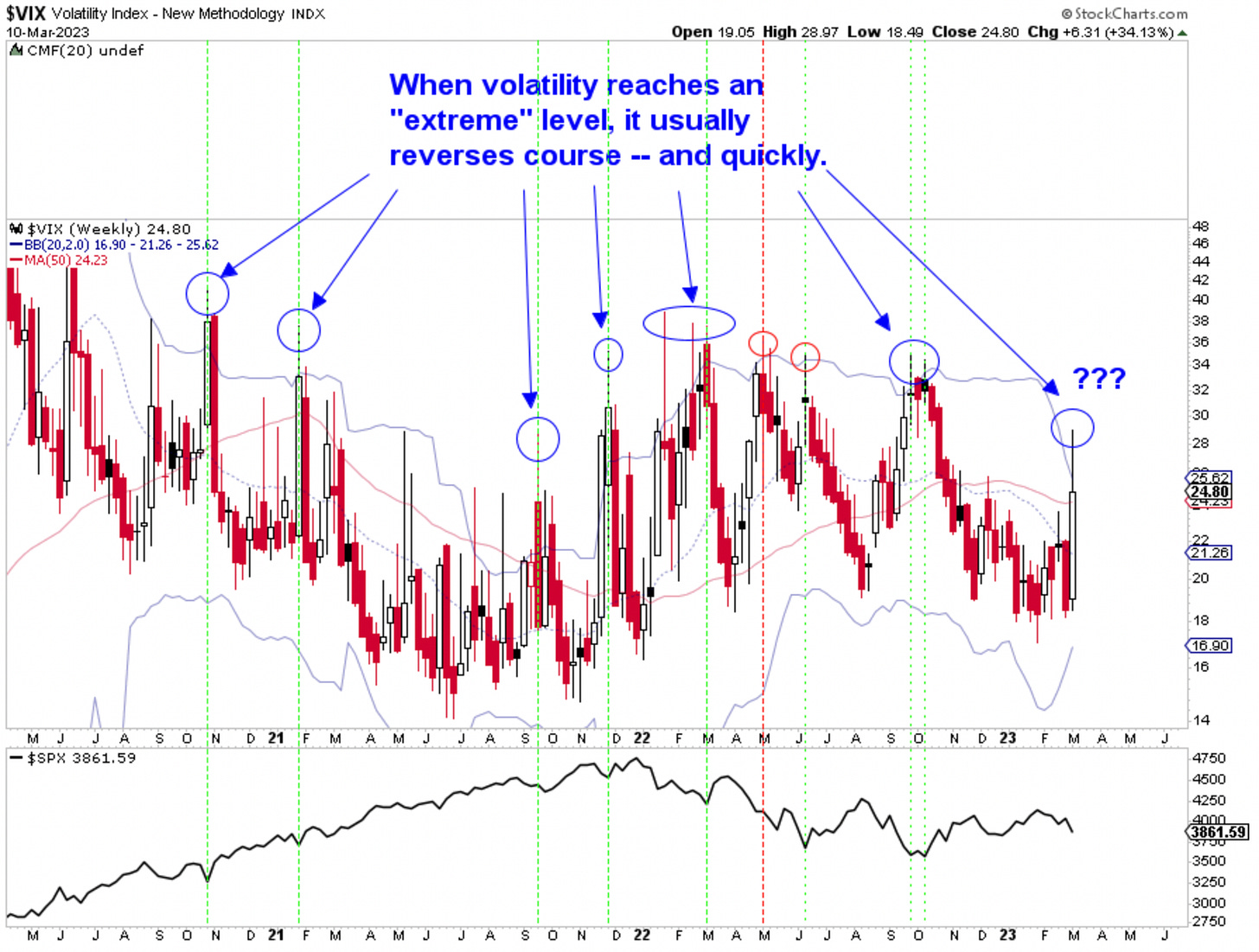

The chart we’re looking at here? The Volatility Index ($VIX), or measure of fear in the market.

Buy When Fear Peaks

You can see from the chart below that fear often hits extreme levels. Yesterday with the announcement of Silicon Valley Bank being shut down, fear peaked — only to retreat.

We measure extreme levels of price and fear by using Bollinger Bands, which gives us the standard deviation away from the mean price. Bollinger gives you extreme prices for anything.

In this weekly chart below, the stock market price either a) bounced or b) continued to rise after fear peaked, 8/9 last times. The S&P 500 is represented by the line at the bottom of the chart.

You can see fear hit an extreme level this week (yesterday) and pulled back hard.

We may get a push higher in volatility, and a drop lower in stocks, but this chart is screaming “buy the dip”.

Me? I bought more at the close yesterday, adding to existing holdings.