🚀 Go Long The Certainty With Gridlock in D.C.

Slowing inflation and a crowded "recession" prediction, now is the time to buy.

Hello investor friends! It’s been a while.

First off, I’d like to say sorry I’ve been MIA. I bought a new business this summer and haven’t had much of a chance to post here. But that’s not to say I haven’t been following the markets….

This week’s news is exactly what I was waiting for. We have gridlock in DC and inflation is slowing down. A few telltale signs point to better days… but first…

Let’s Back it Up for a Second…

In my June post, How Low Will Stocks Go?, I identified the 2020 high as a major area of confluence.

The market bounced off that level on October 13th, and hasn’t quite looked back (btw, it look A LOT longer to get to that level than I anticipated).

Click here to view the original chart. Now that we’ve “bounced” off the area of confluence, which we expected to be a bottom, what’s in store for stocks?

Well, if the midterm elections are any indication, it’s looking good.

Certainty with a D.C. Gridlock = Bullish

What does gridlock mean? No new legislation, and that means certainty, and certainty is bullish.

A lackluster performance by both parties in the midterm elections has guaranteed, for the most part, gridlock in D.C. The Dems lost their majority rule in the House, and we have a 50/50 tie in the Senate. That means no new legislation will come out that can hurt business.

Remember, the Dow averages 48.5% from the midterm elections low (October 13th, 2022?) until the following year’s high (2023).

Take advantage of the certainty.

The Crowd is Always Late to the Ballgame

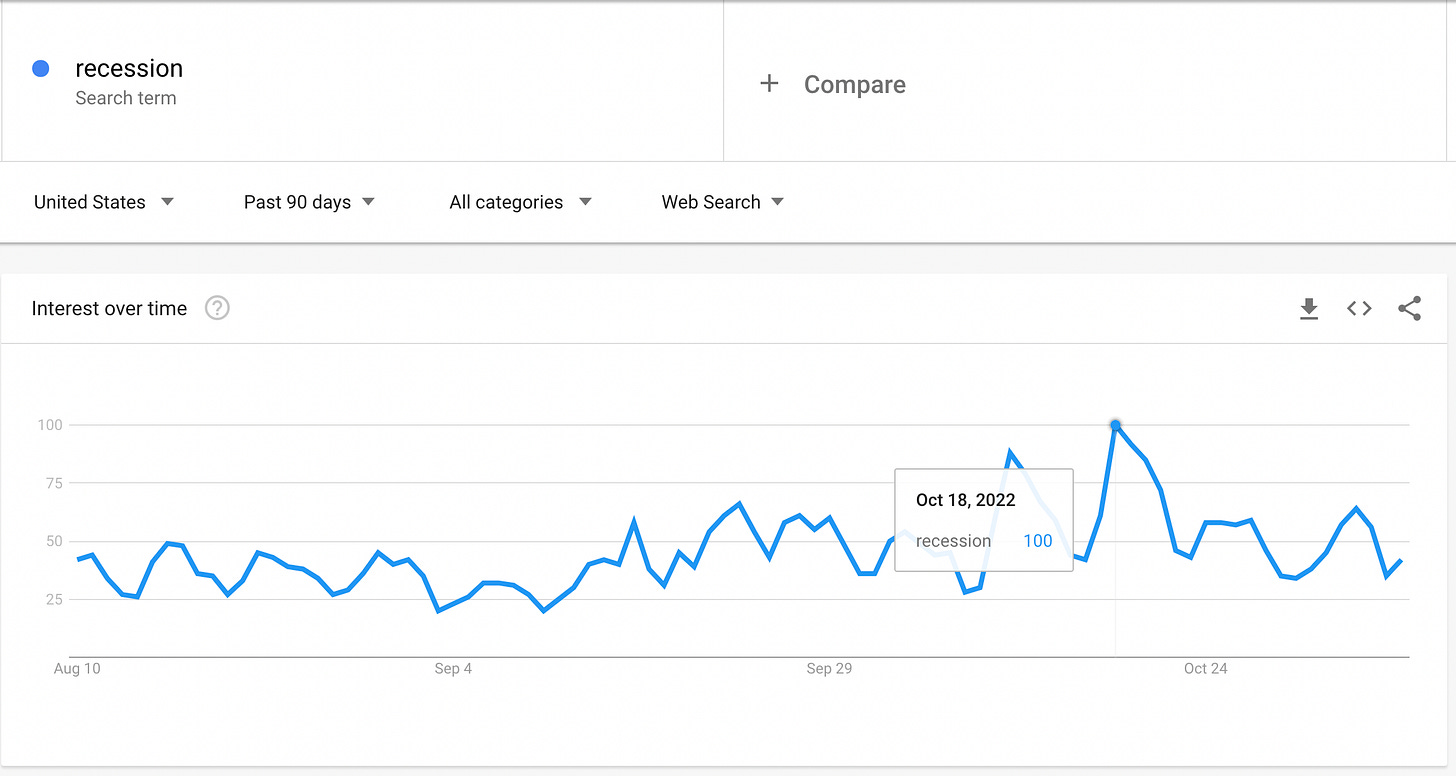

Here’s another interesting anecdote. If you go to trends.google.com and type in “recession”, you’ll see that U.S. searches for the term peaked on October 18th… not surprisingly, just a few days after the most recent bottom:

Given that everyone was searching about a recession in October, the recession is probably behind us and better days are ahead. Remember the Heisenberg Principle.

Remember, the herd is always late to the ballgame.

For the record, I am getting as long as humanly possible, and if the market pulls back, I’m buying more. 🚀