A "Fear Trade" Is Brewing Right Now

Learn to identify the Fear Trade with a quick glance at prices.

I don’t prefer to post intraday but I want to point something out that’s happening right now. It’s a good example, so it’s worth a quick post. As I type this, the “Fear Trade” is underway, which is generally a bearish signal.

What is the “Fear Trade”?

The Fear Trade as I’ve defined it means that market participants are fearful of something to come. Maybe it’s a Fed rate hike, maybe the potential Russian invasion. Or maybe the collective mind of the market simply knows something we do not. Either way, it’s happening right now.

Continue reading or upgrade your subscription to learn more.

The Fear Trade = Bonds Up, VIX Up, Stocks Down

As a rule of thumb, the fear trade is when the following happens:

Bonds are up (yields go down)

The Volatility Index (the fear Index or “Vix”) is up, and..

Stocks are down.

Here is a quick photo from my TradingView App. As you can see, I can identify a potential fear trade in a split second.

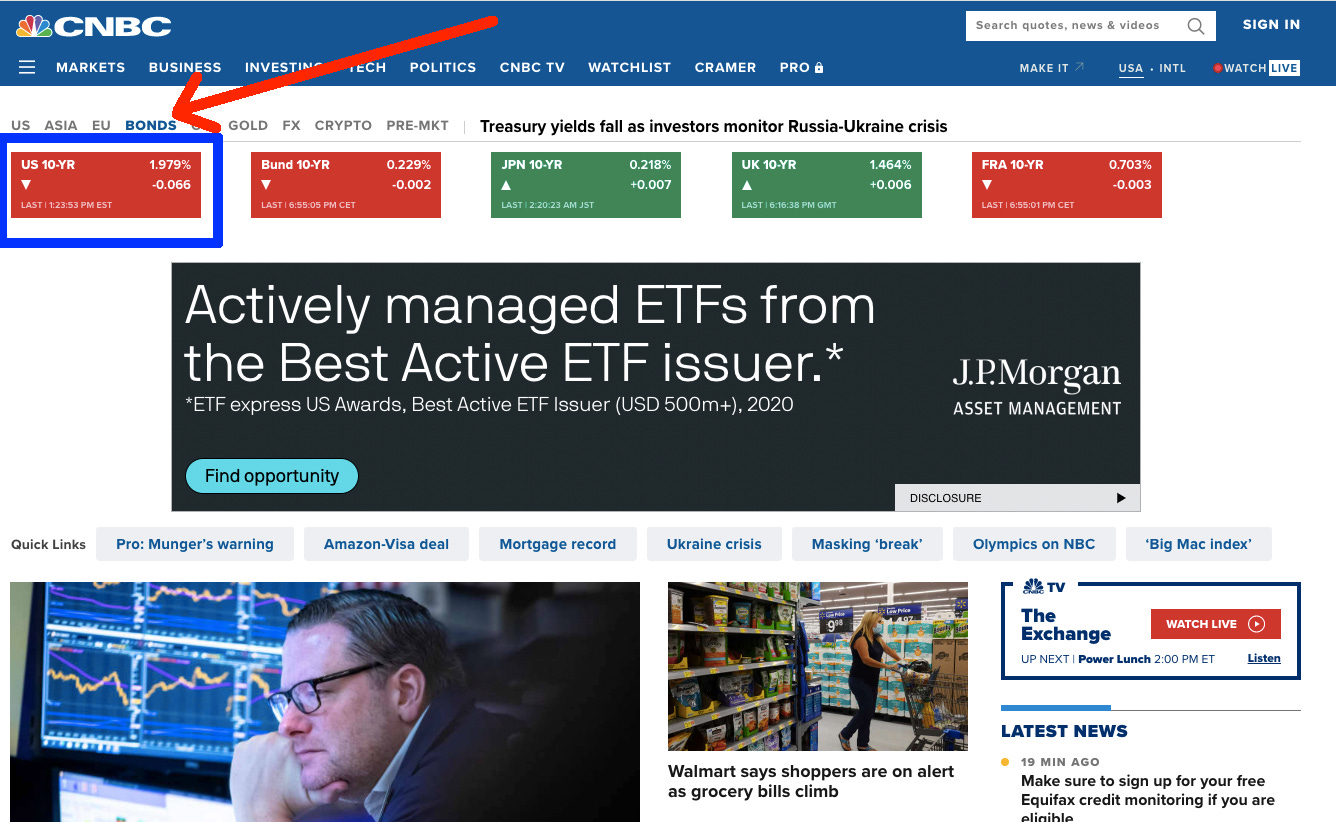

You can also find this by going to CNBC.com and simply looking at what stocks, volatility, and bond yields are doing. You can see them right on the homepage.

To see what Yields are doing, just click “Bonds”

US Government Bonds: a Safe Haven

Historically, when there is fear in the market, people buy US government bonds (i.e. the 10- and 30-year US Treasuries). Yes, despite all the government debt and money printing, investors are creatures of habit… and when they get scared, they buy bonds.

Bond Price & Yields Move In Opposite Directions

The return on bonds, the yield, moves in the opposite direction of bonds. When bonds go up, yields go down. When bonds go down, yields go up.

This is why yields COLLAPSED during March of 2020. Investors loaded up on government bonds as a “safe haven”:

A safe haven means things are getting so scary, investors want to put their money in pocket of the US government… Historically, US bonds are the KING safe haven. But don’t act on this alone…

The Fear Trade is NOT an End All Be All

The Fear Trade occurs when stocks are down, and volatility is up. But you cannot rely on just this alone to trade. This is just one of the many “bellwethers” traders use to position themselves for a big move in either direction (or, if the timing is right, the opposite direction).

The Fear Trade is just something to pay close attention to… something that can position you for a big move before the general public.

Happy Trading 😊

CNBC: Stock futures are flat after Dow suffers its worst day of the year https://www.cnbc.com/2022/02/17/stock-market-futures-open-to-close-news.html